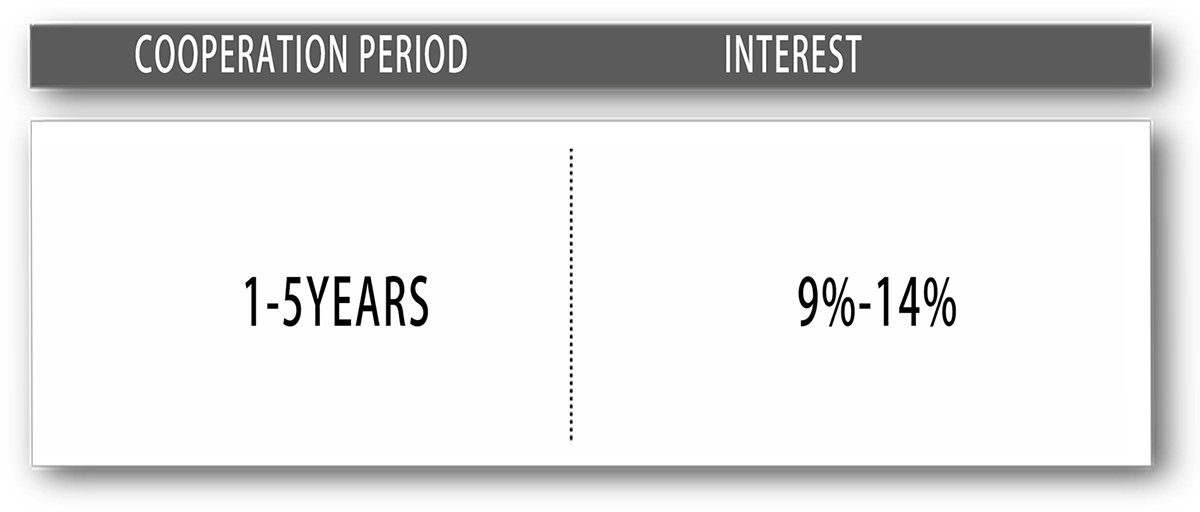

The principal will be repaid at maturity for the dividends listed in the table, and there is no construction period. The company will discuss face-to-face with the enterprise about the details. The dividend rate in the real estate industry is 9%-14%, subject to face-to-face consultation with the responsible investment manager and the financing agreement.

Huaqiaohuili has reached in-depth cooperation with the capital markets of Singapore, Australia, Britain, North America, and the Hong Kong region to provide customers with extensive and high-quality guidance on capital market.

Huaqiaohuili has contact with more than 10,000 securities firms and investment institutions around the world and has established a perfect corporate financing recommendation and service system to provide customers with opportunities to showcase themselves to global investment institutions.

The shareholders of Singapore Overseas Chinese Fund are in charge of about 10 billion US dollars of assets and funds. With strong ability to integrate capital and resources, they are capable of ensuring the security of customers' business.

With years of practical experience, Huaqiaohuili’s high-level legal, fiscal and taxation, architecture and service teams help customers solve pain points and avoid potential risks.

The senior management team has an average of more than 10 years of experience in financial management.

A stable team: serving cooperative enterprises for 5 years on average.

Market-based salary incentive mechanism: executives and employees are highly motivated.

Market-based assessment mechanism: keeping the team active.

Market-based recruitment system: attracting outstanding talents to enhance the company's competitiveness.

The management team has years of experience in working overseas and international duty performance.

The management team is experienced and makes extensive use of the expertise from all quarters. They have global horizons and have contributed a lot to consolidating the company’s business model.